Over 1 Million customers have come to us for advice*

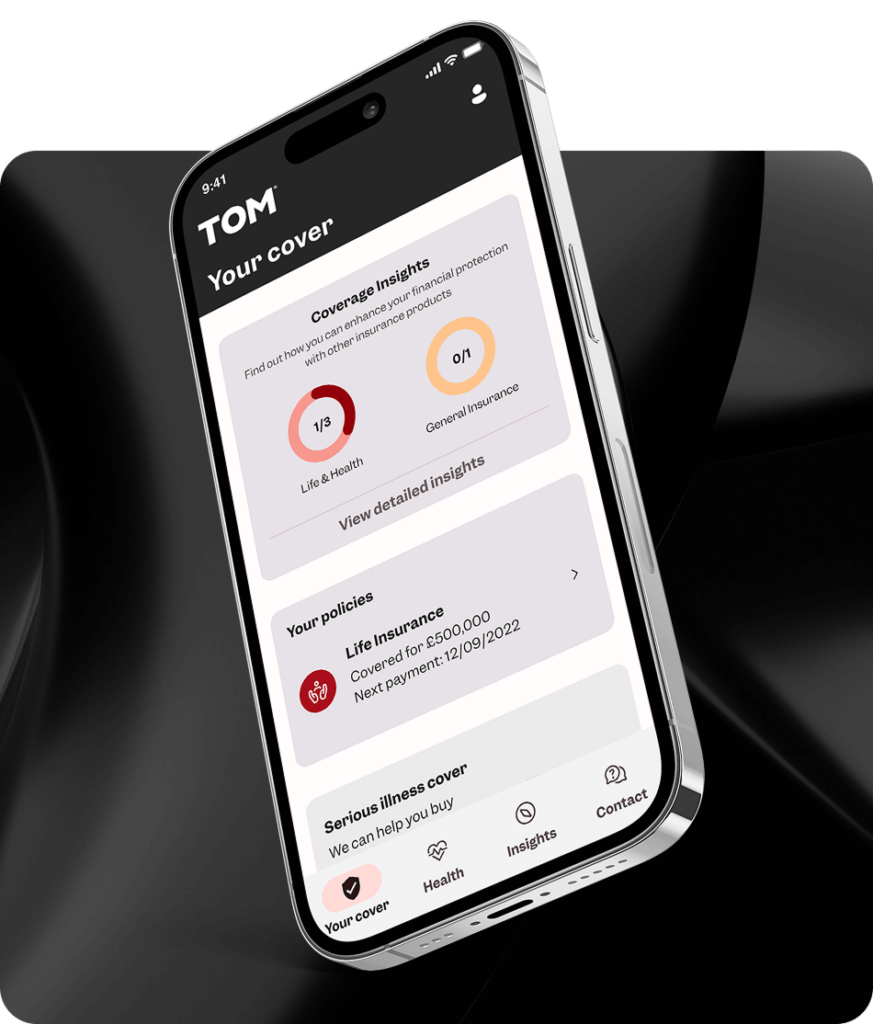

Serious Illness Cover

Being diagnosed with a serious illness is hard enough without added financial pressure. We can help you and your children get covered in the event of a serious illness diagnosis, giving you the mental space to focus on your health.

Start my free quoteWhat is Serious Illness Cover?

Serious Illness Cover, also known as Critical Illness Cover, can help to give you the financial freedom to focus on recovery. You can receive:

Why is Serious Illness Cover Important?

Stability

for Freelancers

Serious Illness Cover can help to provide financial stability if you’re self-employed or freelance and can’t claim sick pay.

Financial Protection Against the Unexpected

You can never predict when serious illness may strike. Last year, several major insurers reported their youngest claimant to be between 21 and 22 years old.

Cover for

Your Kids

You can receive a payout of up to £25k if your children are diagnosed with a serious condition, included as standard in your policy. We also offer £5k funeral cover for up to 3 kids if they sadly pass away.

Financial

Peace of Mind

Serious Illness Cover can help to support you & your family financially, so you can take the time to focus on recovery without worrying about the bills.

What’s Included in Serious Illness Cover?

What’s Usually Covered

- 35 Serious Illnesses, including cancer, strokes and heart attacks

- Enhanced payouts for certain types of cancer

- Waiver of premium & total permanent disability available as optional extras

- Cover against serious illness for up to 3 children

- £5k funeral cover for up to three children

What’s Not Covered

- Diagnosis of serious illnesses not listed in your policy

- Diagnosis of conditions that don’t meet the severity specified

- Any preexisting condition that the insurer decides to exclude

- Children younger than 30 days old OR older than 18 (or 21 if in full time education) are not eligible for Serious Illness Cover

- Children older than 18 (or 21 if in full time education) are not eligible for £5k funeral cover

- You must survive at least 10 days after your diagnosis to be able to make a claim

Typical Serious

Illness Cover Claims

Don’t just take our word for it.

Hear from some of the dads just like you who chose to protect their families’ financial futures with TOM.

Three steps towards financial peace of mind

- Fill in the form

It’s just a few questions, no confusing financial jargon, and you’ll be done before the kettle’s boiled. Once you’re ready, just hit ‘send’. - Talk to us

Expect a call. Not from a robot, but from a real person who’s here to help you find the right cover for you and your family. - Relax

Let’s be honest, you’re a dad & you’ve got loads on. So we’ll handle the tricky stuff while you get on with your day. Simple, huh?

Serious Illness Cover FAQ’s

What is Serious Illness Cover?

Serious Illness Cover is designed to provide a one-off cash payment in the event that you become seriously ill. This money can be used to cover bills if you’re unable to work, support with medical expenses, or just provide some peace of mind that your finances are in order while you recover.

What does it cover?

Following our initial chat with you we’ll provide a list of illnesses your policy will and won’t cover, based on your health and lifestyle, however the most common claims for Serious Illness Cover include cancer, stroke and heart attack.

What does Serious Illness Cover cost?

Like Life Insurance, the cost of Serious Illness Cover will depend on your health and lifestyle, as well as the payout amount. To receive an accurate quote for cover, it’s always best to speak to one of our team for a no-obligation chat.